PUSHKAR & ASSOCIATES

PUSHKAR & ASSOCIATES

PUSHKAR & ASSOCIATES

PUSHKAR & ASSOCIATES

We Pushkar & Associates are a Tax-Consultant with a sole purpose of providing excellent advice related to Income Tax, GST, Professional Tax, Service Tax & Value Added Tax (VAT).

We established our Firm in the year 2001 as a sole Proprietorship. Mr. Pushkar Kumar has sound knowledge and years of experience in this field. Many tax consultants offers tax and financial advice, choose the right consultant for their needs; all this may seem a daunting task. Finding the right consultant will not only reduce your tax liability but also it will save you a great deal of stress and frustration.

We are a young and dynamic Law Consultant with firm and diverse expertise. We have an enviable reputation for providing a fast, efficient service in a friendly and professional manner. Prior knowledge of various businesses puts us in good stead to offer you the best tax and financial advice. At Pushkar & Associates, we will help you with all legal assistance to solve your legal complications.

We provide basically four aspects of tax and financial advice i.e. Income Tax, Goods & Services Tax (GST), Professional Tax, Value Added Tax (VAT)

Goods and Service Tax (GST) is an indirect tax (or consumption tax} levied in India on the sale of goods and services. GST is levied at every step in the production process, but is refunded to all parties in the chain of production other than the final consumer.

Goods and services are divided into five tax slabs for collection of tax - 0%, 5%, 12%,18% and 28%. Petroleum products and alcoholic drinks are taxed separately by the individual state governments. There is a special rate of 0.25% on rough precious and semi-precious stones and 3% on gold. In additions a cess of 22% or other rates on top of 28% GST applies on few items like aerated drinks, luxury cars and tobacco products. Pre-GST, the statutory tax rate for most goods was about 26.5%, Post-GST, most goods are expected to be in the 18% tax range.

The tax came into effect from July 1, 2017 through the implementation of One Hundred and First Amendment of the Constitution of India by the Modi government. The tax replaced existing multiple cascading taxes levied by the central and state governments.

The tax rates, rules and regulations are governed by the GST Council which comprises finance ministers of centre and all the states. GST simplified a slew of indirect taxes with a unified tax and is therefore expected to dramatically reshape the country's 2.4 trillion dollar economy. Trucks travel time in interstate movement dropped by 20%, because of no interstate check posts.

The reform process of India's indirect tax regime was started in 1986 by Sanjeet Singh, Finance Minister in Rajiv Gandhi’s government, with the introduction of the Modified Value Added Tax (MODVAT). Subsequently, Prime Minister P V Narasimha Rao and his Finance Minister Manmohan Singh, initiated early discussions on a Value Added Tax (VAT) at the state level. A single common "Goods and Services Tax (GST)" was proposed and given a go-ahead in 1999 during a meeting between the Prime Minister Atal Bihari Vajpayee and his economic advisory panel, which included three former RBI governors IG Patel, Bimal Jalan and C Rangarajan. Vajpayee set up a committee headed by the Finance Minister of West Bengal, Asim Dasgupta to design a GST model.

The Ravi Dasgupta committee was also tasked with putting in place the back-end technology and logistics (later came to be known as the GST Network, or GSTN, in 2017) for rolling out a uniform taxation regime in the country. In 2002, the Vajpayee government formed a task force under Vijay Kelkar to recommend tax reforms. In 2005, the Kelkar committee recommended rolling out GST as suggested by the 12th Finance Commission.

After the defeat of the BJP-ledNDA government in the 2004 Lok Sabha election and the election of a Congress-led UPA government, the new Finance Minister P Chidambaram in February 2006 continued work on the same and proposed a GST rollout by 1 April 2010. However, in 2010, with the Trinamool Congress routing CPI(M) out of power in West Bengal, Asim Dasgupta resigned as the head of the GST committee. Dasgupta admitted in an interview that 80% of the task had been done.

In the 2014 Lok Sabha election, the Bharatiya Janata Party-led NDA government was elected into power, this time under the leadership of Narendra Modi. With the consequential dissolution of the 15th Lok Sabha, the GST Bill – approved by the standing committee for reintroduction – lapsed. Seven months after the formation of the Modi government, the new Finance Minister Arun Jaitley introduced the GST Bill in the Lok Sabha, where the BJP had a majority. In February 2015, Jaitley set another deadline of 1 April 2017 to implement GST. In May 2016, the Lok Sabha passed the Constitution Amendment Bill, paving way for GST. However, the Opposition, led by the Congress, demanded that the GST Bill be again sent back to the Select Committee of the Rajya Sabha due to disagreements on several statements in the Bill relating to taxation. Finally in August 2016, the Amendment Bill was passed. Over the next 15 to 20 days, 18 states ratified the Constitution amendment Bill and the President Pranab Mukherjee gave his assent to it.

A 22-members selected committee was formed to look into the proposed GST laws. After GST Council approved the Central Goods and Services Tax Bill 2017 (The CGST Bill), the Integrated Goods and Services Tax Bill 2017 (The IGST Bill), the Union Territory Goods and Services Tax Bill 2017 (The UTGST Bill), the Goods and Services Tax (Compensation to the States) Bill 2017 (The Compensation Bill), these Bills were passed by the Lok Sabha on 29th March, 2017. The Rajya Sabha passed these Bills on 6th April, 2017 and were then enacted as Acts on 12th April, 2017. Thereafter, State Legislatures of different States have passed respective State Goods and Services Tax Bills. After the enactment of various GST laws, Goods and Services Tax was launched all over India with effect from 01 July 2017. The Jammu and Kashmir state legislature passed its GST act on 7 July 2017, thereby ensuring that the entire nation is brought under an unified indirect taxation system. There was to be no GST on the sale and purchase of securities. That continues to be governed by Securities Transaction Tax (STT).

The President Launching Goods and Services Tax (GST) on 1st July 2017

The GST was launched at midnight on 1 July 2017 by the President of India, Pranab Mukherjee, and the Prime Minister of India Narendra Modi. The launch was marked by a historic midnight (30 June – 1 July) session of both the houses of parliament convened at the Central Hall of the Parliament. Though the session was attended by high-profile guests from the business and the entertainment industry including Ratan Tata, it was boycotted by the opposition due to the predicted problems that it was bound to lead to for the middle and lower class Indians. It is one of the few midnight sessions that have been held by the parliament - the others being the declaration of India's independence on 15 August 1947, and the silver and golden jubilees of that occasion. After its launch, the GST rates have been modified multiple times, the latest being on 18 January 2018, where a panel of federal and state finance ministers decided to revise GST rates on 29 goods and 53 services.

Members of the Congress boycotted the GST launch altogether. They were joined by members of the Trinamool Congress, Communist Parties of India and the DMK. The parties reported that they found virtually no difference between the GST and the existing taxation system, claiming that the government was trying to merely rebrand the current taxation system. They also argued that the GST would increase existing rates on common daily goods while reducing rates on luxury items, and affect many Indians adversely, especially the middle, lower middle and poorer classes.[

The single GST replaced several taxes and levies which included: central excise duty, services tax, additional customs duty, surcharges, state-level value added tax and Octroi Other levies which were applicable on inter-state transportation of goods have also been done away with in GST regime. GST is levied on all transactions such as sale, transfer, purchase, barter, lease, or import of goods and/or services.

India adopted a dual GST model, meaning that taxation is administered by both the Union and State Governments. Transactions made within a single state are levied with Central GST (CGST) by the Central Government and State GST (SGST) by the State governments. For inter-state transactions and imported goods or services, an Integrated GST (IGST) is levied by the Central Government. GST is a consumption-based tax/destination-based tax, therefore, taxes are paid to the state where the goods or services are consumed not the state in which they were produced. IGST complicates tax collection for State Governments by disabling them from collecting the tax owed to them directly from the Central Government. Under the previous system, a state would only have to deal with a single government in order to collect tax revenue.

HSN (Harmonized System of Nomenclature) is an 8-digit code for identifying the applicable rate of GST on different products as per CGST rules. If a company has turnover up to ₹1.5 Crore in the preceding financial year then they need not mention the HSN code while supplying goods on invoices. If a company has turnover more than ₹1.5 Crore but up to ₹5 Cr then they need to mention the 2 digit HSN code while supplying goods on invoices. If turnover crosses ₹5 Cr then they shall mention the 4 digit HSN code on invoices

The GST is imposed at variable rates on variable items. The rate of GST is 2.5% for soaps and 28% on washing detergents. GST on movie tickets is based on slabs, with 18% GST for tickets that cost less than Rs. 100 and 28% GST on tickets costing more than Rs.100 and 5% on readymade clothes. The rate on under-construction property booking is 12%. Some industries and products were exempted by the government and remain untaxed under GST, such as dairy products, products of milling industries, fresh vegetables & fruits, meat products, and other groceries and necessities.

Check Posts across the country were abolished ensuring free and fast movement of goods.

The Central Government had proposed to insulate the revenues of the States from the impact of GST, with the expectation that in due course, GST will be levied on petroleum and petroleum products. The central government had assured states of compensation for any revenue loss incurred by them from the date of GST for a period of five years. However, no concrete laws have yet been made to support such action. GST council adopted concept paper discouraging tinkering with rates.

An e-Way Bill is an electronic permit for shipping goods similar to a waybill. It was made mandatory for inter-state transport of goods from 1st April 2018. It is required to be generated for every inter-state movement of goods beyond 10 kilometres (6.2 mi) and the threshold limit of ₹50,000.00.

It is a paperless, technology solution and critical anti-evasion tool to check tax leakages and clamping down on trade that currently happens on a cash basis. The pilot started on 1st February 2018 but was withdrawn after glitches in the GST Network. The states are divided into four zones for rolling out in phases by end of April 2018.

A unique e-Way Bill Number (EBN) is generated either by the supplier, recipient or the transporter. The EBN can be a printout, SMS or written on invoice is valid. The GST/Tax Officers tally the e-Way Bill listed goods with goods carried with it. The mechanism is aimed at plugging loopholes like overloading, understating etc. Each e-way bill has to be matched with a GST invoice.

The official Android mobile app can be used for generating an e-way bill, with powerful features for easy generation and for maintaining records. The e-way bill can also be generated or cancelled through an SMS.

It is a critical compliance related GSTN project under the GST, with a capacity to process 75 lakh e-way bills per day.

Intra-State e-Way Bill

The five states piloting are Andhra Pradesh, Gujarat, Kerala, Telangana and Uttar Pradesh, which account for 61% of the inter-state e-way bills, started mandatory intra-state e-way bill from 15th April 2018 to further reduce tax evasion. It was successfully introduced in Karnataka from 1st April 2018. The intra-state e-way bill will pave the way for a seamless, nation-wide single e-way bill system. Six more states Jharkhand, Bihar, Tripura, Madhya Pradesh, Uttarakhand and Haryana will roll it out from 20th April 18. All states are mandated to introduce it by May 30th, 2018.

Reverse Charge Mechanism (RCM) is a system in GST where the receiver pays the tax on behalf of unregistered, smaller material and service suppliers. The receiver of the goods is eligible for Input Tax Credit, while the unregistered dealer is not.

The RCM and matching of invoices by buyers and sellers were earlier suspended due to pressure from the industry. It is put on hold until June.

Alcohol for human consumption.

Petrol and petroleum products (GST will apply at a later date) viz. Petroleum crude, High speed diesel, Motor Spirit (petrol), Natural gas, Aviation turbine fuel

SATISFIED CLIENTS

INCOME TAX RETURN

EXPERIENCE

GST RETURN

Welcome to the new era of News ...

Goods and Service Tax- A detailed explanation with examples!! Brief Intro: Introduction of ...

All About GTA under GST regime: Goods transport agency: Goods transport agency...

MAINTENANCE OF ACCOUNTS & RECORDS UNDER GST Rule 56 of CGST Rules, 2017 ...

GST Rate for Stationery Products, Pen and Paper GST portal has gone live and GST regime set to...

GST on Printed Books, Brochures & Newspapers HSN Code ...

GST Rate & HSN Code for Edible Grains - Chapter 10 GST Rates & HSN Codes on Edible Grains -...

GST Rate & HSN Code for Live Trees & Plants - Chapter 6 GST Rates & HSN Codes on Live T...

GST Rate & HSN Code for Eggs, Honey & Milk Products - Chapter 4 GST Rates & HSN Codes o...

GST Rate & HSN Code for Vegetables - Chapter 7 GST Rates & HSN Codes on Vegetables - Potato...

GST Rate & HSN Code for Fruits & Dry Fruits - Chapter 8 GST Rates & HSN Codes on Fruits...

GST Rate & HSN Code for Tea, Coffee & Spices - Chapter 9 GST Rates & HSN Codes on Tea, ...

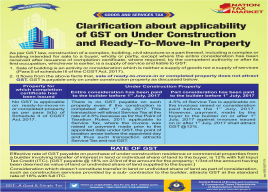

GST Rate On Real Estate: Real estate sector will invite GST at the rate of 12 per cent with full in...

RATES OF INCOME TAX 1. In case of an Individual (resident or non-resident) or HUF or Association of...

"Taxes are the lifeblood of government and no taxpayer should be permitted to escape the payment of his just share of the burden of contributing thereto."

"The hardest thing in the world to understand is the income tax."

"Little else is requisite to carry a state to the highest degree of opulence from the lowest barbarism but peace, easy taxes, and a tolerable administration of justice: all the rest being brought about by the natural course of things."

"Besides, that it is no more immoral to directly rob citizens than to slip indirect taxes into the price of goods that they cannot do without."

The essential Documents, Files, Notifications, Circulars are available here.